Retailers aren’t just expanding their shelves – they’re expanding their ecosystems.

By turning marketplaces into media engines, sellers are becoming the fuel behind a high-margin, high-growth flywheel. Here’s how it works.

As commerce shifts from owned inventory to orchestrated ecosystems, retail giants are building something bigger than shelves – they’re building platforms.

The marketplace model is enabling retailers like Kingfisher, Carrefour, ASOS and Walmart to scale choice, attract sellers, and – critically – power the flywheel of retail media.

This is where merchandising meets monetisation. And it’s just getting started.

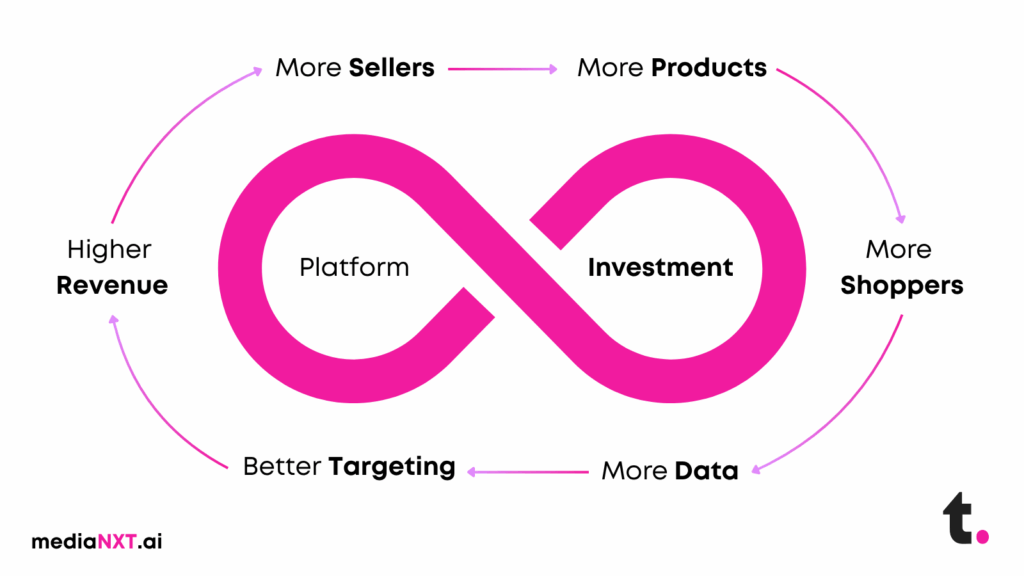

Retailers are evolving into platforms – not just to sell more, but to monetise more. By embracing marketplace infrastructure and third-party sellers, they expand range, improve margins, and unlock new monetisation levers, including media, data, and fulfilment.

Marketplace growth is now tightly coupled with the rise of Retail Media Networks (RMNs) – turning product listings and shopper data into high-margin ad inventory.

The Marketplace Model: Why it Matters

Retailers aren’t just chasing GMV. They’re building:

It’s a structural pivot – from merchant to orchestrator. And it’s fuelling faster growth than first-party alone.

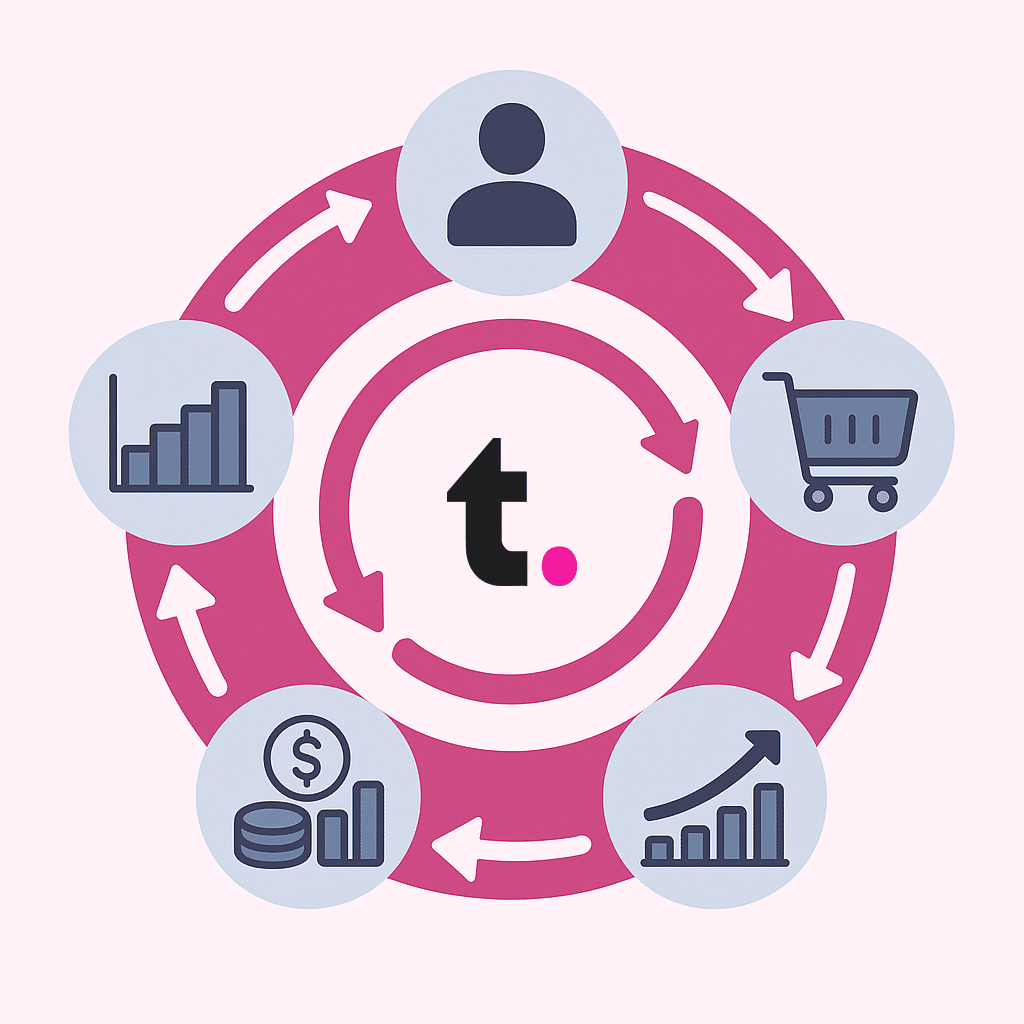

Fuel for the Retail Media Flywheel

Retailers with marketplaces gain more than sellers – they gain signals. Every third-party listing, click, and conversion adds data to the system. This powers a retail media flywheel:

Retailers like Amazon, Walmart, Kingfisher and ASOS are proving the compounding effect: seller growth → traffic growth → media growth.

Players Rewriting the Playbook

Kingfisher (B&Q , Screwfix, Castorama, Brico Depot): Launched marketplace to expand its DIY assortment and drive 25% of e‑commerce sales via third-party sellers.

Bunnings: Unveiled a curated marketplace offering 60,000+ home and lifestyle SKUs via “Trusted Sellers,” complementing its in‑store range and e‑commerce strength.

Home Depot: Rebranded as Orange Apron Media and acquired GMS ($5.5B) to enhance its marketplace and pro B2B delivery stack.

ASOS: Home to 1,300+ independent brands, ASOS Marketplace supports sustainable fashion, upcycled labels, and social selling integrations.

Carrefour: Via Rue du Commerce, Carrefour blends grocery, electronics, and general merchandise into a cross-category, cross-border marketplace.

MediaMarkt: Combines a centralised digital backbone with regional store franchise agility – allowing for local assortment with global reach.

Walmart: Operates a vast marketplace powering Walmart Connect, WFS, and over $100B in e-commerce, with enhanced AI and seller tools.

eBay: The original marketplace pioneer – now revitalised by promoted listings, visual search, and AI-powered dynamic pricing.

Amazon: Marketplace now accounts for over 60% of unit sales, with Sponsored Products powering the largest RMN in the world.

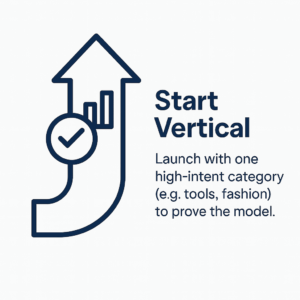

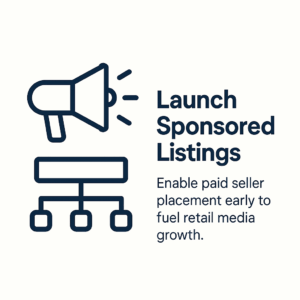

Blueprint for Marketplace Maturity

Building a thriving marketplace doesn’t happen overnight – it’s a strategic journey. Retailers that succeed don’t just onboard sellers; they activate an ecosystem that scales with their brand, customer base, and media ambitions. Here’s a proven blueprint to guide that journey:

Marketplace maturity isn’t just about more sellers. It’s about better experiences – for customers, sellers, and advertisers alike. When built strategically, marketplaces become the connective tissue between commerce, content, and community

The Tech Stack Behind the Strategy

Modern marketplaces don’t just list products – they orchestrate data, media and fulfilment at scale. At the heart of the evolution lies a new generation of modular, API-first technologies designed to give retailers control, speed, and scalability.

These tools are not just add-ons – they are the foundation of modern marketplace and media strategies.

At the core is platforms like Mirakl, a marketplace engine used by global retailers to rapidly onboard third-party sellers, grow product ranges, and launch new propositions without heavy custom development.

For end-to-end shopper and advertiser journeys, Salesforce Commerce Cloud and Media Cloud bring commerce and media together – powered by unified customer data through CRM and real-time personalisation via Data Cloud. Tableau Next then translates this data into insight, helping retailers and sellers optimise spend, track performance, and align with marketplace goals.

To manage product visibility across multiple channels, platforms like ChannelEngine and Lengow support dynamic listing, pricing, and inventory updates. And on the media delivery side, Criteo, CitrusAd, and Google Ad Manager enable campaign targeting, ad serving, and closed-loop measurement directly within marketplace environments.

The common thread across all these tools? Composable architecture – giving retailers the flexibility to build tech stacks around their strategy, not the other way around. The result: marketplaces that don’t just scale, but monetise.

Retailers as Ecosystem Orchestrators

Marketplaces aren’t replacing stores. They’re expanding reach, enriching choice, and powering the next frontier of revenue – retail media.

The retailers winning today aren’t just selling more products. They’re selling access: to audiences, to data, and to digital shelf space.

They’re curating ecosystems where owned products, third-party sellers, and brand advertisers coexist – each fuelling deeper engagement, richer insights, and higher-margin growth.

Retailers are no longer just merchants. They’re media owners, data platforms, and technology companies rolled into one.

By integrating commerce, content, and customer intelligence, marketplaces become more than transactional – they become strategic. They unlock cross-border potential, support long-tail assortment, and enable brands to activate full-funnel campaigns directly within the shopping experience.

“Retailers are becoming the platforms. And marketplaces are the gateway to their growth.

This isn’t just evolution. It’s a redefinition of retail’s role in the digital economy.